U.S. economic reports have been sparkling. The economy appears to be booming, the labor market looks strong and inflation seems to be on the decline.

Yet this seemingly propitious combination has locked the Federal Reserve into inaction. At its policymaking meeting this week, the Fed decided to do precisely nothing. It held the main policy rate, known as the federal funds rate, steady at about 5.3 percent, where it has stood since August.

In a statement on Wednesday after the two-day session, the Fed said it would not cut interest rates “until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” And during a news conference, Jerome H. Powell, the Fed chair, emphasized that the Fed was proceeding cautiously and still waiting for “a true signal” that it was time to act.

But with inflation waning, the markets want much more.

Market Desires

The stock market is positively aching for a cut in interest rates. In past cycles, when the Fed began easing interest rates, risk seekers often saw that as an invitation to start partying. The S&P 500 hit a record in January, but stocks haven’t risen as sharply as they probably would have if a rate-easing cycle were already underway.

The S&P 500 fell 1.6 percent on Wednesday, with a decline fueled by Mr. Powell’s comments during the news conference, after he said, “I don’t think it’s likely” that the Fed will cut rates in March.

Expectations of rate cuts have waxed and waned over the past several months. So has the behavior of the stock market. After the Fed’s previous meeting in December, in which it signaled that rate cuts were likely sometime in 2024, the futures market began to count on the start of those rate cuts being at the Fed’s next meeting, in March.

By late Wednesday, after Mr. Powell’s comments, the probability of a rate cut in March, as expressed by the futures market, had dropped below 40 percent. For the Fed’s May meeting, the probability of a quarter-point rate cut was about 60 percent, but even that market outlook could prove optimistic.

Similarly, bond yields — which are set by the market and not by the Fed — have risen since December. Recall that yields soared last summer and autumn, when the Fed appeared to be committed to keeping short-term rates “higher for longer” to combat inflation, while the economy remained surprisingly robust. Because bond yields and prices move in opposite directions, this rise in yields punished bond investors. Now, the last thing the bond market wants is higher yields, but despite a minor decline in late January, yields have risen so far this year.

In 1977, Congress instructed the Fed to “promote effectively the goals of maximum employment, stable prices and moderate long term interest rates.” Three goals are listed here, but “moderate long term interest rates” are supposed to be the natural consequence of an economy that has maximum employment and stable prices. So it is often said that the Fed has a “dual mandate.”

At the moment, the two parts of that mandate are in tension, if not utter conflict.

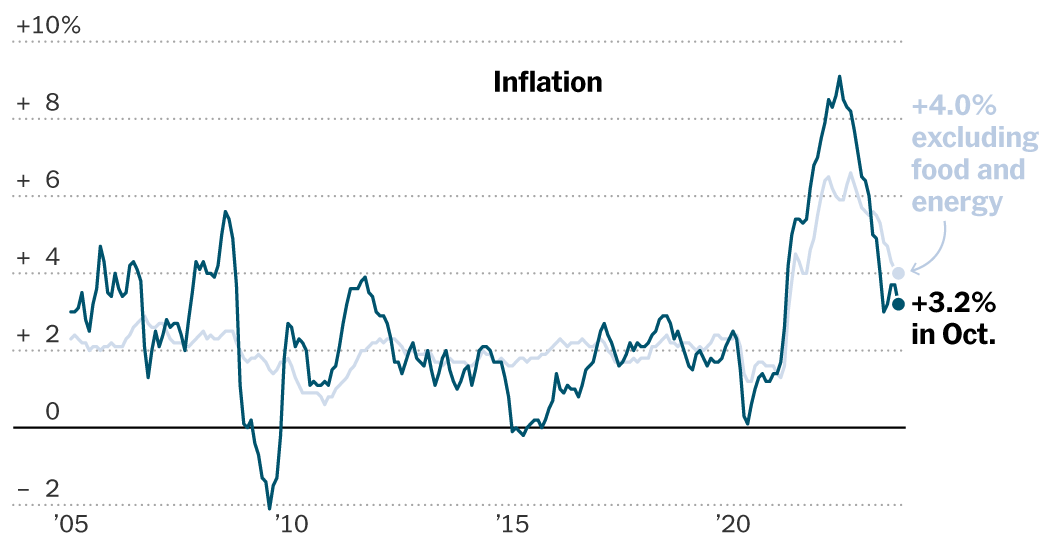

First, there’s stable prices — and its nemesis, runaway inflation. The inflation rate has dropped below 3 percent in recent readings, but it’s still above the Fed’s 2 percent target, and Mr. Powell does not want to risk a surge in inflation that could occur if the Fed cuts rates prematurely. Something of the sort happened in the 1980s, when Paul A. Volcker was the Fed chairman, and had to tame double-digit inflation. He cut interest rates too soon, and needed to raise them again, throwing the economy into two recessions.

Mr. Powell says he wants to be worthy of the Volcker example. Holding the line on interest rates until inflation is well and truly contained is Mr. Powell’s stated priority.

Then there’s maximum employment. The unemployment rate, which will be updated on Friday, has been below 4 percent for two years. The United States has been as close to maximum employment as it’s been in decades. At some point, when interest rates rise high enough, the economy is expected to slow down and people are supposed to lose jobs en masse. That has yet to happen: No recession has materialized.

But Mr. Powell has also said that he expects the Fed to begin cutting rates well before inflation fell all the way to 2 percent. In a December news conference, he explained, “I mean, the reason you wouldn’t wait to get to 2 percent to cut rates is that policy would be, it would be too late.” Wait too long and the Fed would “overshoot,” he said, because “it takes awhile for policy to get into the economy, affect economic activity and affect inflation.”

The Fed’s inflation-fighting battle would, in other words, conflict with its effort to keep employment high. It could throw the country into a needless recession.

Art, Not Science

Economics aims to be a science. But economic policymaking is an art that requires delicate timing and astute political judgment.

As the Fed approaches a pivot in this policy cycle — from tightening financial conditions to, at some point, loosening them — the real-world implications are manifold. This is, in every sense, a high-stakes game.

It matters to everyone with a job, everyone who buys goods and services, everyone with a saving account or money-market fund, everyone with the desire to buy a house, or with investments in the stock and bond markets or, really, in just about every market.

The chances of a recession in the United States and the world economy have diminished, the International Monetary Fund said in its latest estimation. But risks remain. Energy prices could easily move significantly higher in response to conflict in the Middle East. Consumer spending, which has fueled the economy, could start to flag. Interest rates could begin to really bite, dislocating vulnerable sections of the economy.

Yet so far, in this economic cycle, the Fed has been marvelously successful, preserving jobs while dampening inflation. And, at this point, since the start of Fed tightening early in 2022, most investors are whole — having largely recovered from the big losses of 2022.

This benign climate has insulated the Fed from political pressure, though its actions will have a bearing on national elections this year. At the moment, the economic effects on the political landscape are too close to call, though the combination of low inflation and robust growth in recent months has modestly improved prospects for Democrats, according to a long-running model operated by Ray Fair, the Yale economist.

As I’ve noted, the Fed is likely to come under fire if it waits too long to lower interest rates. It could be seen as intervening in politics, if it were to take action close to the elections in November. Starting a rate-lowering cycle by, say, June, as the markets now widely expect, should provide an ample buffer to preserve the Fed’s appearance of political independence.

Putting all this together, I’m expecting interest rate cuts to start sometime in the first half of 2024, though how soon within that span is anybody’s guess.

The Fed is in a difficult position. The timing of its rate shift is ticklish. It’s difficult to be patient when everyone is urging you to act.